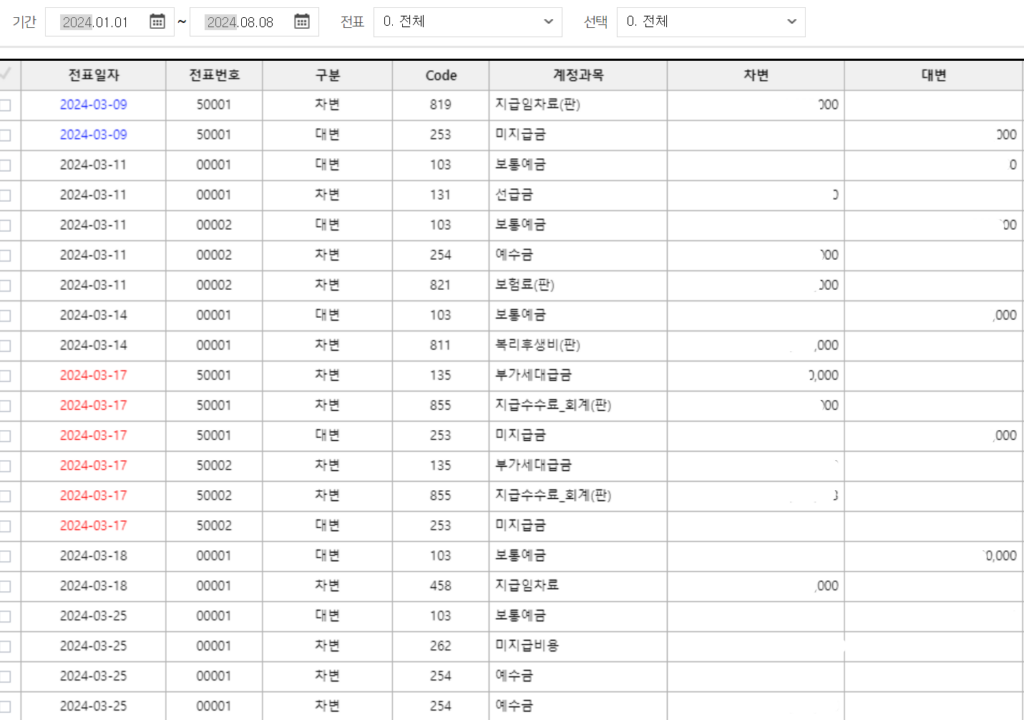

The image above shows the actual screen from our ledger. All company transactions are recorded here and are used to prepare the company’s balance sheet, income statement, and other financial statements.

Introduction

In today’s competitive landscape, utilizing bookkeeping services is crucial for efficient financial management.

Bookkeeping is the backbone of any successful business operation. It refers to the systematic recording and organizing of financial transactions, which is crucial for maintaining accurate financial records.

Efficient and accurate financial management is essential for business success. Companies, whether large or small, often face the choice of maintaining an in-house accounting team or outsourcing their accounting and bookkeeping needs to professional firms. This article explores why businesses need these services and the regulatory requirements in Korea that make accounting and bookkeeping essential.

Additionally, bookkeeping services allow businesses to track their income and expenses efficiently, making it easier to prepare for tax season and make informed financial decisions throughout the year.

Benefits of Professional Accounting/Bookkeeping Services

Utilizing professional bookkeeping services also helps businesses manage their cash flow effectively, which is vital for day-to-day operations and long-term planning.

Accuracy and Compliance

Professional accounting firms ensure that all financial records are accurate and comply with the latest regulations. This is particularly important in Korea, where tax laws are frequently updated by the National Tax Service (NTS) and other authorities.

Time and Cost Efficiency

Moreover, outsourcing bookkeeping services enables businesses to leverage advanced technology and software solutions that may be cost-prohibitive for them to implement in-house. These solutions often include automated invoicing, expense tracking, and financial reporting, which streamline operations and reduce human error.

Expertise

Accounting firms employ professionals who are experts in their field. They are well-versed in the latest accounting standards and tax laws, ensuring that companies benefit from the highest level of expertise.

With the help of bookkeeping services, companies can also receive tailored financial advice and strategic insights that can significantly impact their growth trajectory. This access to expertise can help identify opportunities for cost reduction and revenue enhancement.

Focus on Core Business

By outsourcing accounting tasks, businesses can focus more on their core activities, such as sales, marketing, and product development, which can drive growth and profitability.

Scalability

As businesses grow, their accounting needs become more complex. Professional firms can easily scale their services to meet these changing needs without the company needing to hire additional staff.

In addition, professional bookkeeping services can assist in developing budgets and forecasts, allowing businesses to plan for future expenses and investments more effectively.

Regulatory Requirements and Compliance in Korea

In Korea, companies must adhere to specific accounting and financial reporting standards. The key regulations include:

These regulations are designed to enhance transparency, accountability, and integrity within the business environment, which can lead to increased investor confidence and improved market stability.

Korean Generally Accepted Accounting Principles (K-GAAP)

While not all companies are required to prepare financial statements in accordance with K-GAAP, larger companies and those seeking external audits must comply. For more information, see the Korean Institute of Certified Public Accountants (KICPA). Smaller companies typically maintain records primarily for corporate tax reporting purposes.

External Audit Requirements

Companies that exceed certain thresholds in terms of assets, revenue, or employee numbers must undergo external audits. The Act on External Audit of Stock Companies mandates these audits to enhance transparency and protect stakeholders.

Furthermore, compliance with these regulations can also protect businesses from potential legal issues and penalties, reinforcing the importance of maintaining accurate and up-to-date financial records.

Tax Compliance

Companies must comply with various tax obligations, including corporate tax, value-added tax (VAT), and payroll taxes. Failure to comply can result in significant penalties. Official guidelines and filing deadlines are published by the National Tax Service. Professional accounting firms help ensure timely and accurate tax filings.

This proactive approach to tax compliance ensures that businesses are well-prepared for audits and can demonstrate their commitment to adhering to legal obligations.

Internal Controls

Effective internal controls are required to prevent fraud and ensure the integrity of financial information. Businesses are expected to establish proper systems for risk management and governance, which professional accounting firms can help design and implement.

Developing strong internal controls not only helps prevent financial discrepancies but also fosters a culture of accountability within the organization.

Conclusion

Maintaining accurate and compliant financial records is essential for any business. In Korea, the regulatory environment further necessitates the need for professional accounting and bookkeeping services. Whether a company opts for in-house bookkeeping or outsources to a specialized firm, the benefits of accuracy, compliance, cost-efficiency, and expert knowledge cannot be overstated.

The peace of mind that comes from knowing financial records are in good hands allows business owners to focus on innovation and customer service, ultimately driving growth and success.

By entrusting these critical functions to professionals, businesses can focus on what they do best – growing and succeeding in their respective markets.

In conclusion, the integration of bookkeeping services within a business strategy is not just an operational decision; it is an investment in the future success and sustainability of the organization.